Hello, Here is the details of {{mpg_bank}} of Branch {{mpg_branch}}

| Bank Name: | {{mpg_bank}} |

| Bank IFSC Code: | {{mpg_ifsc}} |

| Branch Name: | {{mpg_branch}} |

| Branch Address: | {{mpg_address}} |

| Branch City: | {{mpg_city1}} |

| Branch District: | {{mpg_city2}} |

| Branch State: | {{mpg_state}} |

| Branch Contact No.: | {{mpg_std_code}} – {{mpg_phone}} |

Nearby {{mpg_bank}} Branches

No Branches found nearby

What is IFSC Code?

The Indian Financial System Code (IFSC) is a distinctive 11-character alphanumeric code crucial for online fund transfers through NEFT, RTGS, and IMPS. Easily located on your cheque leaf, the IFSC code is assigned to banks by the Reserve Bank of India (RBI). Beyond the cheque, you can access the IFSC code on the bank’s official website or the RBI website.

For seamless net banking transactions, entering the IFSC code is mandatory. Typically, banks don’t alter the IFSC code unless there’s a merger. To transfer funds successfully, you only need the beneficiary’s name, bank branch details, account number, and the specific IFSC Code for that branch. It’s vital to ensure accuracy in the IFSC code to avoid any misdirected funds to another branch. Simplify your online transactions by understanding and correctly inputting the unique IFSC Code for each bank branch.

How Does IFSC Works?

Let’s Explore the STATE BANK OF INDIA IFSC code example to grasp the essence of IFSC and its role in banking transactions. For instance, the IFSC code for Canara Bank’s DUMRAON Branch is SBIN0003027.

Breaking it down:

- SBIN signifies State Bank of India.

- The 5th character, 0, is reserved for future use.

- The remaining 6 characters, 003027, uniquely identify the bank branch for RBI.

Understanding how IFSC operates is key. When initiating a fund transfer, providing the recipient’s account number and branch-specific IFSC code is essential. This ensures accurate transactions, and the money is seamlessly transferred to the intended account holder.

Beyond fund transfers, IFSC codes facilitate the purchase of insurance and mutual funds via net banking. Monitored by the Reserve Bank of India’s (RBI) National Clearing Cell, IFSC codes play a pivotal role in tracking and executing error-free fund transfers.

Locating your IFSC code is easy; it can be found on your cheque book, bank passbook, or in your monthly account statement. Remember, each bank branch’s IFSC code is unique, ensuring precision in every transaction. Simplify your banking experience by understanding and using the distinctive IFSC code associated with your bank branch.

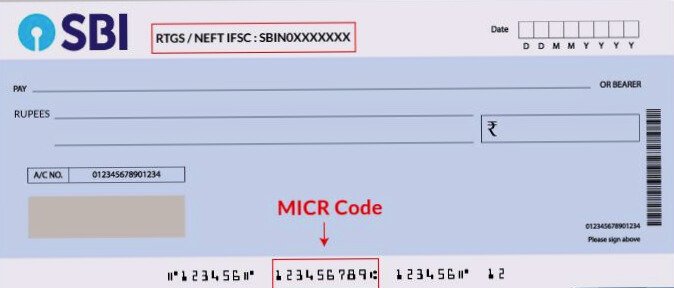

Locate IFSC and MICR Code on a Bank Cheque :

Many of our previous discussions focused on the everyday bank cheque. This essential part of the banking world is made up of different elements that work together to confirm its authenticity, giving us full confidence in its usability.

Every standard bank cheque must include the IFSC code, which differs between banks. In our example image, we’re showcasing the specific location of the IFSC code on an SBI Cheque. Understanding where to find this code is crucial for hassle-free transactions.

Disclaimer: While we strive to maintain the latest information sourced from RBI, users are encouraged to verify details with their respective banks before relying on the information provided. The author retains the right to disclaim responsibility for the timeliness, accuracy, completeness, or quality of the information. Any liability claims related to damages arising from the use of incomplete or incorrect information will be disclaimed.